ATM Machine Rental is one of the many services provided by Emerson Amusements. If you’re operating any type of venue or store, an ATM is a vital piece of equipment you should have. Why wouldn’t you want your customer to have instant access to retrieve more cash that they can spend in your business?

Moreover, when people in the neighborhood come to know you have an ATM, or if you display a sign that you have one, you’ll generate traffic into your business from people wanting — or needing — to access their money And once inside, who knows, perhaps they make an impulse buy.

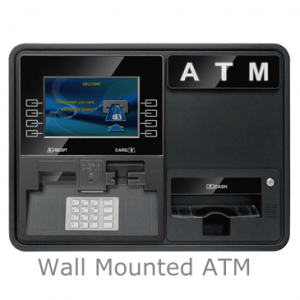

Emerson provides many ATM options, including floor and wall-mount models.

So contact us to order one today.

What Is an ATM?

An ATM, or Automatic Teller Machine, is a machine that allows customers of banks and other financial institutions to withdraw cash from their accounts without having to visit a teller. Customers can also use ATMs to check their account balances, deposit cash and checks, and transfer money between accounts.

accounts without having to visit a teller. Customers can also use ATMs to check their account balances, deposit cash and checks, and transfer money between accounts.

ATMs are typically located in public places such as banks, supermarkets, and gas stations. Some ATMs are operated by the financial institution that owns them, while others are operated by independent companies.

Most ATMs require the user to insert a debit or credit card into the machine and enter a PIN (Personal Identification Number) in order to access their account. Once the user’s identity has been verified, they can select which services they would like to use.

How Do ATMs Work?

ATMs are one of the most convenient ways to access cash, but have you ever wondered how they work? ATMs are computerized machines that dispense cash and perform other banking functions. They are usually located in public places, such as banks, grocery stores, and gas stations.

ATMs are one of the most convenient ways to access cash, but have you ever wondered how they work? ATMs are computerized machines that dispense cash and perform other banking functions. They are usually located in public places, such as banks, grocery stores, and gas stations.

To use an ATM, you first need a bank card. This is inserted into the machine, and you then enter your PIN on the keypad. The ATM will then dispense the requested amount of cash.

ATMs are a quick and easy way to get cash when you need it. However, it is important to remember that they are also machines, so they can sometimes malfunction. If this happens, it is best to contact your bank or credit union for assistance.

The History of ATMs

ATMs were first introduced in 1967 by Barclay’s Bank in London. The machines were designed to dispense cash to customers who had inserted a special cheque into the machine. The cheques were encoded with information about the customer’s account balance and authorized the machine to dispense a corresponding amount of cash.

ATMs first became widely available in the United States in 1969, when Chemical Bank installed them in all of its branches. Other banks quickly followed suit, and ATMs became a fixture at banks and other financial institutions.

Today, there are more than 3 million ATMs worldwide, and they are used by billions of people every day. ATMs have come a long way since their introduction over 50 years ago and have become an essential part of our global financial infrastructure.

ATM Machine Rental

Benefits of Using an ATM

There are many benefits of using an ATM, including convenience, security, and efficiency.

- ATMs are convenient because they are available 24 hours a day, 7 days a week.

- They are also typically located in close proximity to where people live and work.

- They provide instant access to cash for customers in your venue

- ATMs are secure. They use state-of-the-art security features, such as encryption and authentication, to protect customers’ personal and financial information. Additionally, most ATMs have cameras that help to deter crime.

- ATMs are efficient. They can process transactions quickly and accurately. This is especially beneficial for people who need to withdraw large amounts of cash or make multiple withdrawals in a short period of time.

How to Use an ATM Safely

Most people use ATMs without a second thought, but there are some safety concerns to be aware of. Here are a few tips for using an ATM safely:

- Be aware of your surroundings. If you feel like you are being followed or watched, go to a different ATM.

- Have your card ready before you approach the machine. This will help you avoid fumbling around and making yourself a target for criminals.

- Shield your PIN from view when entering it into the machine. Again, this will help to prevent criminals from stealing your information.

- If the ATM looks like it has been tampered with, do not use it and report it to the bank immediately.

- Be aware of your surroundings when withdrawing cash from the machine. Count the money quickly and put it away before leaving the area.